Constant income and you may evidence of a career. Being able to render at least 2 yrs of income and you will a career information is a simple need for most of the financing.

Maximum FHA amount borrowed

Advance payment anywhere between 3.5%-10%. The latest advance payment lowest getting an enthusiastic FHA financing is usually down than simply traditional loan, and certainly will be as low as 3.5% based on your credit rating and you will financial.

Step one: Determine whether an FHA mortgage is the correct complement your

Property requirements pertain. You’ll not qualify for an FHA loan if your domestic your want to buy will not solution the latest appraisal processes, that’s more strict with this sort of loan than old-fashioned mortgages.

How much cash your acquire don’t meet or exceed the new FHA loan limits; so it matter alter according to the county that is influenced by how high priced your local was $822,375 (have a look at HUD information to ensure the latest limits.)

The first step throughout the FHA procedure are deciding if so it style of loan it really is caters to your needs. If you are having trouble qualifying getting a conventional financial, either because of a keen imperfect credit history, highest debt-to-income ratio, or minimal downpayment savings, an enthusiastic FHA loan may provide a viable way to homeownership. Review the latest qualifications more than locate a sense of if your meet up with the minimum conditions getting FHA individuals, and then glance at your credit rating and you may savings observe what kinds of certain FHA lending options is available to you.

Step 2: Choose which lender we should run. Understand that there are many traditional loan lenders than just accepted FHA loan lenders, so you might have to do some investigating before looking one to. Most useful Mortgage offers one another choices and our very own FHA finance are available in most 50 states. Because the an electronic financial, we’ve got got rid of a lot of control, origination, and you can payment charges that will drive within the cost of performing having antique loan providers. Additionally, all of our on the web products allow simple to quickly contrast loan facts and determine intricate rates to know exactly how various other deposit amounts and you can rates affect the full value of every home loan. Note: if you submit an application for an FHA financing having Best, needed an effective 580 minimum credit rating.

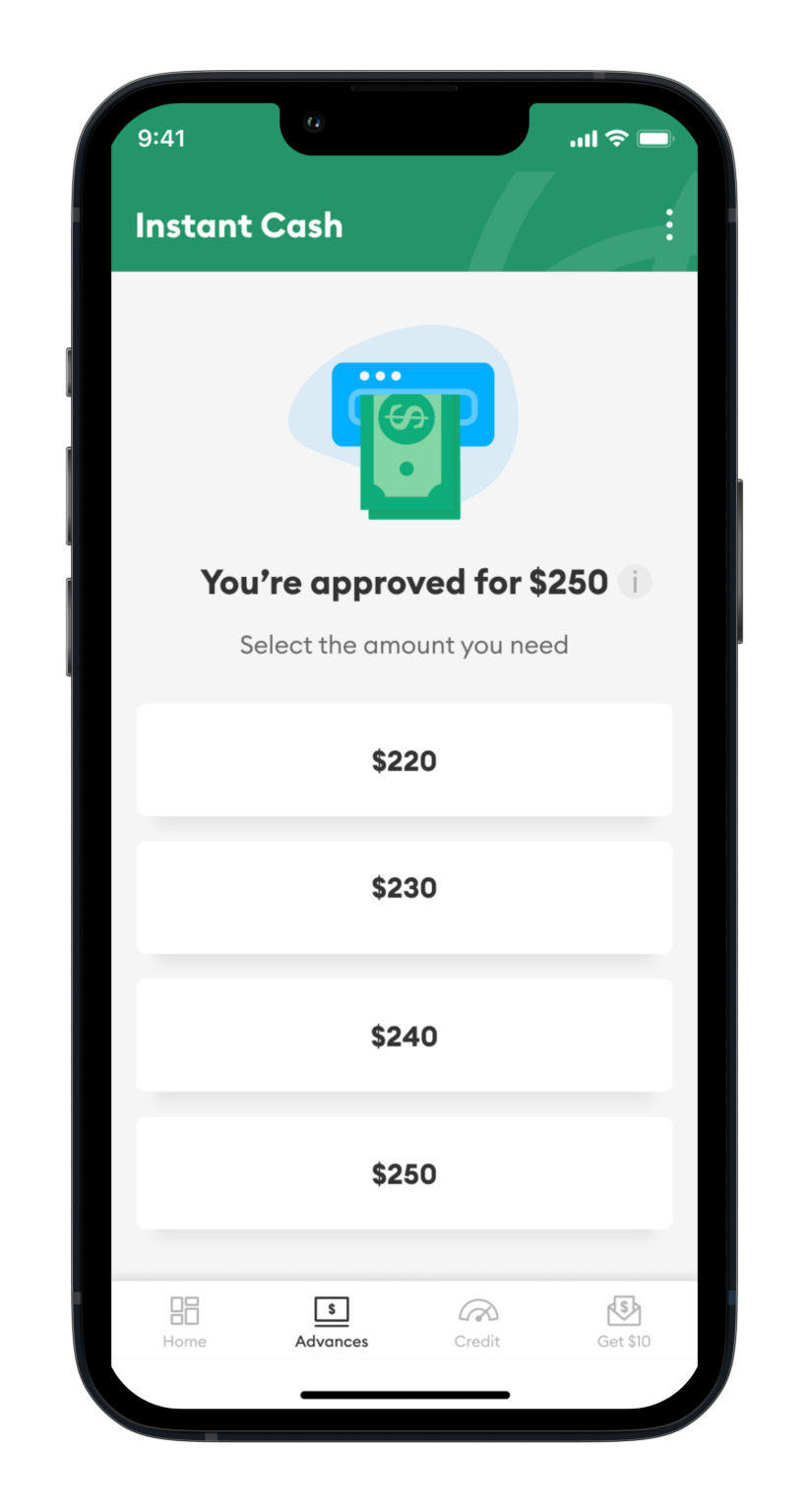

Step 3: Score pre-acknowledged to ascertain simply how much you could potentially borrow. If you know the financial institution we would like to work on, get pre-recognized to find out just how much you could borrow along with your FHA mortgage. Really lenders would like to see a couple of very first documentation, such as for example proof identification, evidence of a career, proof home, and you may appropriate W2 and you will taxation versions over the past 2 yrs. On Ideal, our very own on the web procedure is super simple-we are going to ask you to answer about your income and you will possessions then perform good soft credit pull (this does not affect your credit rating). Then voila! You should have a free, zero commitment pre-recognition page that delivers you a precise guess of the homebuying possible. Once the other lenders render different cost, you will want to comparison shop to obtain the best choice by comparing mortgage personal loans for bad credit Connecticut rates.

Step four: Fill in the job when you get a hold of property you like. If you’d like to improve your odds of bringing approved to own an FHA financing, definitely meet the minimum conditions in depth above: particularly, be sure to keeps a credit score with a minimum of five-hundred, a debt-to-earnings proportion out of 43% otherwise reduced, and you can enough currency arranged to possess a down-payment between step three.5% and you may ten% dependent on the perfect credit score. Past these minimums standards, remember that you’ve got issues qualifying to have an FHA mortgage when you yourself have insufficient credit score, a reputation to make late repayments, tall an excellent personal debt, or any current foreclosures otherwise bankruptcies. After you work at Top Mortgage, you’re going to be tasked a loan consultant who can walk you through the procedure and address any queries you have got.