Mortgage loans, family security financing and you may HELOCs usually charge all the way down interest rates than simply personal loans, but when you don’t pay off them, you could clean out your house. Or even want to use your house while the security, imagine a personal loan.

Specific unsecured loan team bring personal loan amounts as much as $100,000, sufficient for even major renovations. Unsecured loans typically have repaired rates and you will fees terms of 24 to 84 days, and may even costs charge and additionally origination costs. You will likely you want a premier money, lower DTI and you may advisable that you higher level borrowing so you can be eligible for the newest better prices and terms and conditions.

In the event your borrowing from the bank is just reasonable, your ounts are generally down, and you will charge can truly add into total cost. The latest annual percentage rate (APR) is as high just like the thirty-six% based the credit.

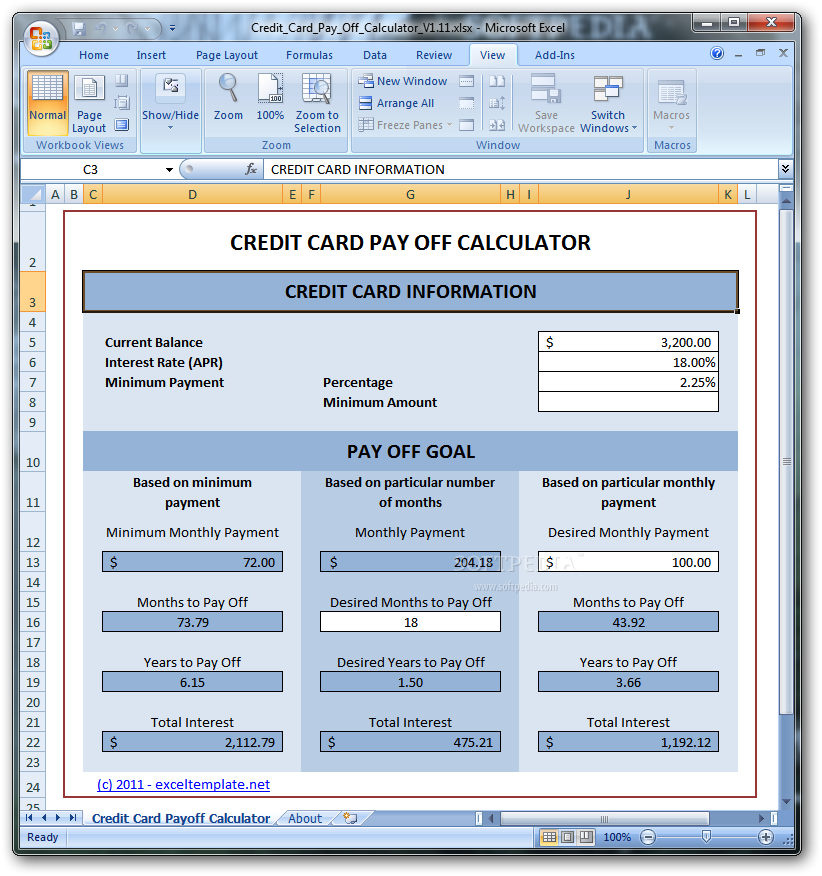

When you take away financing, it is critical to understand what you really can afford and you can what it will cost you. Particularly, for individuals who had a good $ten,000 personal bank loan having a great sixty-month title, 36% Annual percentage rate and 5% management payment, you might spend a supplementary $several,260 in desire having a complete cost of $twenty two,760.

Personal bank loan Calculator

All the info given is actually for educational intentions just and cannot feel construed because the financial information. Experian never ensure the precision of your results offered. Your own financial can charge almost every other costs having maybe not already been factored contained in this calculation. These abilities, in accordance with the guidance available with your, depict a price and you should speak to your individual economic advisor concerning your kind of demands loans Lincoln Park CO.

Exactly what Credit history How would you like to own a house Improve Financing?

Qualifying having a property equity mortgage, cash-away refinance or HELOC generally requires advisable that you higher level borrowing (a FICO Score ? away from 670 or maybe more). In the event the credit try fair (a beneficial FICO Score regarding 580 to help you 669), you might still be able to get a loan, nonetheless it may have a top interest, thus it is possible to spend additionally date. Before you apply having a house upgrade financing, check your credit file and credit score. Whether your credit rating need an improve, was this type of steps to improve it:

- Lower personal credit card debt. Your borrowing from the bank utilization rate can be better not as much as 30% of your available borrowing.

- Provide people late membership current.

- Create all of your obligations costs timely.

- You should never get some other this new credit.

- Create Experian Improve o This 100 % free provider adds into-big date electric, portable and you may streaming provider money with the credit history, probably providing their FICO Get a fast raise.

- Dispute people inaccurate advice in your credit report.

Where you might get a house Update Financing

Offered a cash-out refinance, family security financing otherwise HELOC? Get hold of your newest home loan company observe whatever they could offer. Up coming rating also offers from other financial or household guarantee lenders, comparing rates of interest, closing costs, repayment conditions and you may charges. Consider using a mortgage broker who’ll get rates and you may pointers away from several lenders.

Signature loans are available out of banking companies, borrowing unions an internet-based-simply loan providers. Start out with your current financial or credit partnership, upcoming research rates. But never drag the method away a long time. After you make an application for financing and bank checks the credit, they grounds a challenging query in the credit history, that may briefly ding the get by a number of activities. Unnecessary tough issues normally adversely apply at their borrowing from the bank scoreplete every the loan programs within a fortnight, however, and they’re going to getting addressed as a whole inquiry. Particular lenders usually prequalify your for a loan, and that counts given that a soft query and will not impression your own borrowing results. Experian can be suits you with loan providers that fit your credit profile.