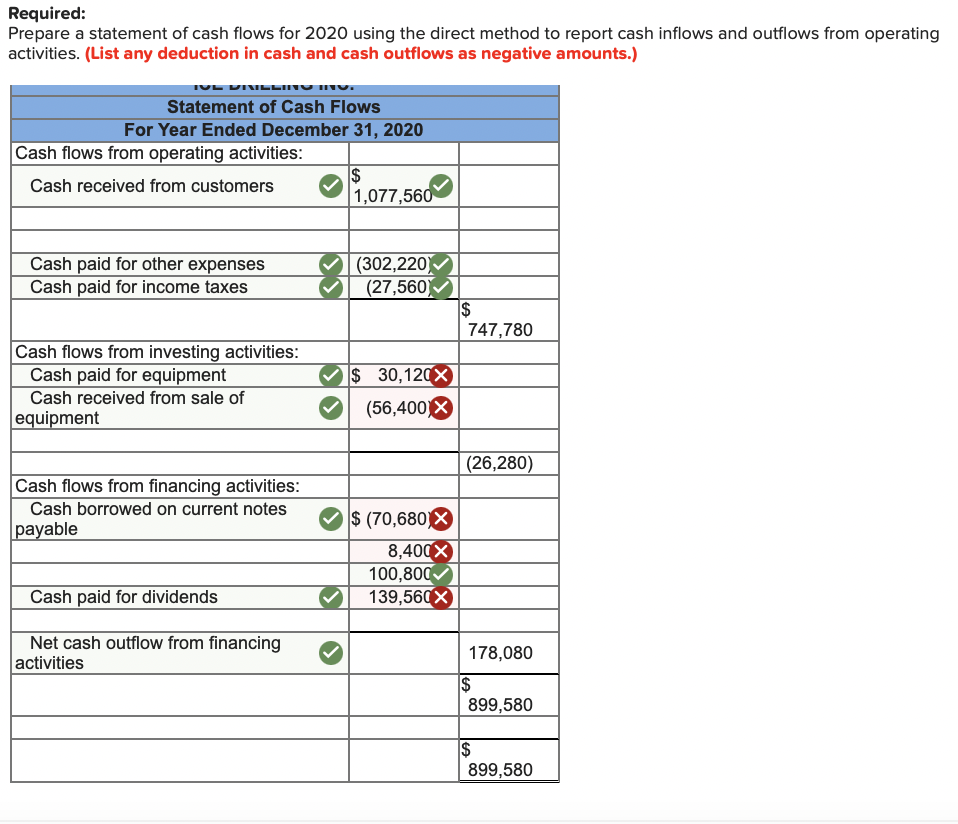

The today-defunct HOLC authored a couple of guidance to own appraising house opinions. The principles was indeed predicated on housing industry requirements, financial qualities, and you can neighborhood demographics. Mortgage brokers who wanted to safe financial backing from the government was in fact needed to follow the lay assistance. Finance companies and you can lenders made use of the individuals guidance to draw domestic coverage maps to own 239 metropolises across the U.

HOLC Redlining Charts

HOLC agents do speak with urban area officials, loan officials, appraisers, and realtors to style charts one to recognized new credit exposure having communities across the U.S. The fresh communities was basically following color coded in writing maps labeled as home-based safeguards charts. Including, neighborhoods coded which have green was basically believed an informed areas and you will depicted minimum of quantity of exposure to have loan providers. Neighborhoods coded red-colored was indeed mainly Black colored and you will categorized because the large risk. Just to illustrate out-of how features were codified:

- Green/Levels An excellent (Best): The assessment property value such features try expected to boost otherwise will still be high. This score as well as represented a low risk of standard to possess loan providers.

- Blue/Grade B (Nevertheless Desirable): These types of properties was basically anticipated to look after the appraised worthy of. This score depicted a fair default chance to possess loan providers.

- Yellow/Levels C (Declining): Brand new assessment worthy of during these attributes are expected to disappear. That it get illustrated a life threatening default exposure for loan providers.

- Red/Levels D (Hazardous): These types of features were elderly and often close unappealing otherwise unhealthy commercial areas and that considered to features minimal well worth. Which rating depicted a risky standard risk getting loan providers.

Exactly how Redlining Impacted Black Homeowners

Black colored homeowners were disproportionately affected by redlining for a few reasons. Earliest, since the system’s racist design favored Light homeowners, it absolutely was extremely problematic for a black homebuyer to obtain acceptance to possess financing inside communities with high appraisal beliefs which were anticipated to rise through the years.

Since americash loans Wedowee loan providers sealed them regarding such areas, Black homeowners must look to unappealing communities you to, oftentimes, was founded close commercial websites. Cost was more affordable, but Black colored homeowners ended up expenses way more when you look at the appeal while the neighborhoods was in fact deemed risky in line with the ages and you can updates of land and their distance to industrial elements.

Because of those higher rates, Black home owners ended up with little or no financial move room so you can manage fixes and you may improve their home. As a result, Black people were caught in the a vicious circle deliberately perpetuated of the federal property organizations and you can loan providers where its neighborhoods was basically distress however, there was little or no they might do in order to increase otherwise refrain their situation, when you find yourself Light homebuyers, that program unjustly recommended, preferred ascending property thinking and you can low interest rates.

Redlining and you can Deal To shop for

The practice of offer purchasing did hand-in-hand that have redlining to help you demolish new generational insightful Black colored homeowners and frequently remaining all of them without having any collateral. In the bargain to find, the customer tends to make a downpayment and you will monthly installments, that happen to be have a tendency to unfairly exorbitant by unscrupulous providers which wanted to benefit from Black Us americans. The seller manage support the action on the home and require the fresh homebuyer to meet up with several commonly unjust and you may discriminatory criteria until the action was passed over.

Shut-out off nicer neighborhoods due to redlining, and you can attacking up against a financing program very often made mortgage loans often too expensive otherwise impossible to get, Black homebuyers, particularly those who work in il, looked to package to purchase just like the a history lodge.

If your homebuyer broken people requirements of your own bargain-say, getting late for the home financing payment one day-the latest home’s manager you will definitely stop them out. This new homebuyer perform eradicate their downpayment and all the installment payments. Furthermore, as they did not own the fresh action on home, new homebuyer wasn’t entitled to people equity our house hit while it lived in it.