If you find yourself a first-day family client, utilize the guide less than to have helpful hints and you may info and you may understand how to prevent prominent errors when buying your first domestic.

- Pre-Qualification: Speak to a mortgage broker to discover how much your have enough money for pay money for a home.

- Pre-Approval: Whenever you are knowing how far you can afford ‘s the first step, manufacturers would-be significantly more responsive in order to potential customers that have already been pre-recognized. You will also don’t let yourself be distressed whenever chasing property that are from the price range. With Pre-Recognition, the customer indeed applies to have home financing and you can get an union on paper out-of a lender. That way, and when your house you have in mind was at or under the matter youre pre-entitled to, owner understands quickly your a life threatening customer having that property. Costs for pre-approval are usually nominal and you may lenders will make it easier to outlay cash when you intimate the loan.

- Range of Needs & Wants: Generate dos listing. The original includes issues need to have (i.e., the amount of rooms you prefer into sized your household members, a one-story house in the event the access to was one thing, an such like.). The second list will be your wants, issues wants to has (pond, den, an such like.) but that are not essential. Realistically getting first-day buyers, you truly doesn’t rating everything you on your own should listing, nonetheless it helps to keep your on track for what you are trying to find.

- Logo by the an expert: Vona loans Believe employing their real estate agent, one who is assisting you to, the customer, maybe not the vendor.

- Desire & Organization: For the a handy location, remain convenient what exactly that will assist you for the enhancing your own family look perform. Such as for example situations include:

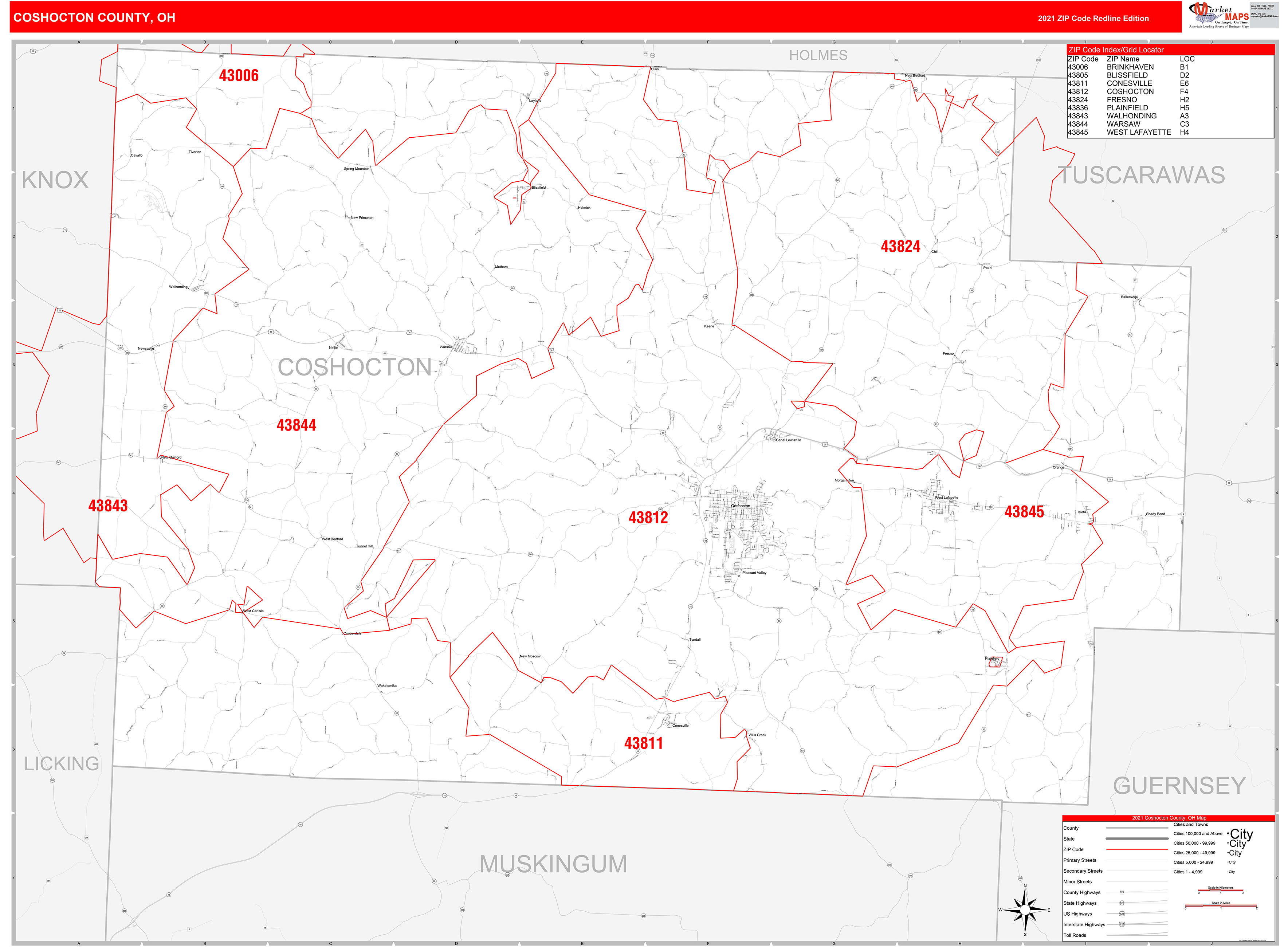

- One or more detail by detail charts with your regions of appeal showcased.

- A document of your own characteristics that your particular broker indicates so you’re able to your, and additionally advertisements you have cut-out regarding paper.

- Paper and you can pen, when deciding to take cards because you search.

- Instant otherwise video camera to assist rejuvenate your own recollections into individual properties, specifically if you was attending a few showings.

All of the above may seem rather daunting. For this reason which have an expert represent you and sustain track of all the details for your requirements is highly recommended. Delight contact us straight to speak about some of these issues into the next detail.

Whenever a primary-go out family consumer begins hunting for the brand new award that have to serve one another since a reasonable domestic ft and you may a stronger financial support, most end up being a mixture of thrill (a property was a good landmark end!) and perhaps merely a little bit of apprehension. Like any costs you have never encountered before, it is compatible when deciding to take special care the very first time aside and to pay attention to just what experience instructs. Along those individuals lines, below are a few problems that will be easy for a first-big date home visitors and then make. Thankfully, also an easy task to sidestep having a Jeff Create Genuine Property pro representative at your side:

1. Awaiting a far greater price

Adjustable pricing could well be regarding as little as they are going to get today and some cues indicate a keen increase in the new coming months. Having an initial-big date house customer in the Sc that are taking right out financing, when your property is right, hesitating and make a commitment centered on financing price enjoy are hardly ever best.

2. Convinced short term

Consider thinking of a home while the a lifestyle investment. For even folks who are unmarried otherwise newly-married, you will be able one to are accessible to a property that have most room may end up rescuing most toward moving, purchase and you will agent charges, taxation, etcetera. It’s equally important to consider areas and exactly how he is modifying and you can development. If you do sell your house, area makes a big difference in how. Our very own basic-day house customer realtors during the South carolina may help you think in the long run before buying the first household.

3. Underestimating undetectable costs

New month-to-month homeloan payment is not the ultimate conclusion. Whenever a first-big date family customer for the South carolina comes across a property you to fulfills (or is higher than) that which you he or she has been looking to own, in the event your mortgage payment seems getting proper, you can neglect most other citizen costs. Experienced buyers generate hardheaded rates out-of repairs charge and you may property taxes as they will become just as consequential because financial bill.

For a primary-go out house consumer inside the Sc, when careful angle gets into up to you, it is that much prone to become a choice one pays out of eventually. When you find yourself preparing to purchase in 2010, new Jeff Make Party will be condition by the to help get your been!