Posts

- What types of areas are a great Martingale strategy most commonly utilized?

- Implementing the brand new Martingale Approach in various Gambling Scenarios

- The new Martingale EA: A risky, Yet , Profitable Strategy

- Is the Martingale program exactly like the fresh twice-down means?

- Just how do buyers create risk while using the Martingale means?

The brand new Martingale method is usually in line with the presumption your likelihood of achievements in the a trade is actually fifty%, and this isn’t constantly true. Accordingly, the fundamental issue with the fresh Martingale method is brief gains that have occasional high loss. Mouse click Spot Martingale trading bot and select your chosen change mode.

What types of areas are a great Martingale strategy most commonly utilized?

Such systems ensure it is people to system their trade bots to perform the brand new Martingale approach, doubling the positioning dimensions after each losses and you will resetting just after a good winnings. Consequently, the new investor minimizes the trade dimensions by the you to definitely unit after each winnings, according to the religion that each successful trade contributes one to unit over the very last trading destroyed. This technique is ideal for traders which favor never to exposure large volumes or pursue losings, allowing for regular growth aimed with field style.

Implementing the brand new Martingale Approach in various Gambling Scenarios

- A major around the world monetary downtrend will simply devalue the cost of the particular currency yet not to no account.

- You opt to stay in the fresh exchange and you may double your own trade dimensions in order to $20, however longing for outcome step 1.

- This will help look after an everyday means and you may suppresses the methods out of spiraling out of control.

- Bettors was drawn to the newest allure from a playing program you to definitely promised consistent profits.

- By doing so, we limit the prospective profit otherwise losings to equal quantity.

Another problem is that the it’s likely that not often equivalent for gamblers and traders — a martingale program never be winning with a possibility to earn below 0.5. In roulette, red-colored or black has only an excellent 18/37 possible opportunity to win (because of zero); in This market, there is a broker’s bequeath, which changes the newest chance from the investor. Of several gamblers hardly understand you to a single completely wrong play can be cost her or him a king’s ransom. In theory, everything sounds plausible, but it’s harmful whenever used on real-community conditions and you will actual games. And, not everybody and contains the necessary funding so you can double down consecutively.

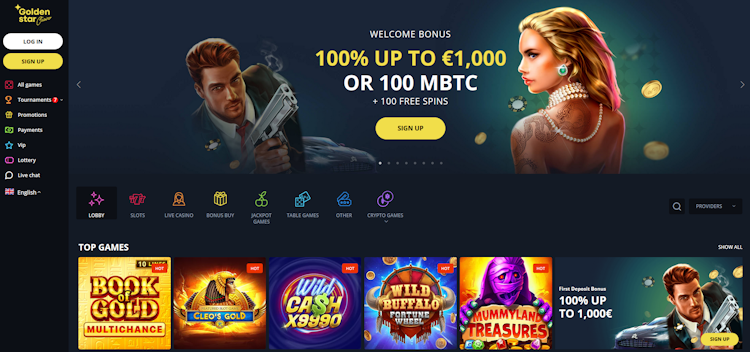

As stated prior to, the new Martingale strategy deal built-in threats, making it crucial to thoroughly make sure https://realmoney-casino.ca/best-online-casinos-for-real-money/ view its performance prior to deploying it in the real time change. As a result the newest EA can add on the change several minutes, experience reversals, and often close investments at a loss. The newest Martingale strategy comes into play right here, plus it’s vital to understand their implications. My travel on the Martingale EA began whenever i filed a couple movies from the a great $ten bot I purchased in the marketplaces. After research they to the a trial account for more than 1 month, We noticed which yielded a great money using Martingale beliefs. However, I became not entirely came across because the robot lacked openness in the regards to its underlying means.

The most important thing to own investors to carefully look at the hazards and you can advantages of employing the newest Martingale approach just before applying they inside its exchange. Even when both tips has their advantages and disadvantages, it’s vital to dictate the initial aspects yourself as the there is no you to-size-fits-all method. Think of, profitable change isn’t only on the method; it’s along with from the abuse, patience, and you may persisted understanding. Thus, the newest individual succeeded in the first change, twofold its reputation size, and you may forgotten regarding the 2nd trading. Following, the newest buyer halved their position size and you may, for the 2nd exchange, lost 2% of its harmony. From the fourth trade, they risked just one% of your harmony but been successful.

The new Martingale EA: A risky, Yet , Profitable Strategy

The brand new hypothetical greatest condition for it means might possibly be an established bull industry. It may commercially along with work effectively within the momentum change because the, with more customers in the business, the expense of the safety have going large. Naturally, simply to summarize once more, this can be the hypothetical.

Is the Martingale program exactly like the fresh twice-down means?

The fresh martingale system (labeled as the fresh martingale method) try a threat-looking to type using. Consider providing the newest about end element, which adjusts the brand new avoid-loss level because the trading actions in your favor. This permits you to get payouts if you are providing the change area to breathe.

I’ve handled through to it earlier, however, fundamentally a fixed fractional design have a tendency to limitation exposure to a predetermined exposure percentage for the any given trading. Specific people will find it getting some time traditional, but not, usually, it gives to find the best mix of upside prospective and restricted danger of ruin situation. First and foremost, it reduces the drawdown exposure unlike amplifying it as are characteristic of Martingale steps. Really educated traders know that one of the most key elements in order to victory in the business try an investor’s capacity to do chance. The new Anti-Martingale program has established-in the mechanisms for reducing risk for every trade, meaning that sooner or later reducing the threat of wreck of your change account.

The newest Anti-Martingale method is sensed a quicker risky approach since it decreases the danger for each and every change and in the end decreases the risk of losing currency. They assumes on that you take advantage while in the expansive progress, and is experienced a standard and you may logical currency-government design. The main challenge with this method are obtaining enough supply of money, as it might capture more than a few positions one which just funds. For those who lack investment before that takes place, there’ll be destroyed all of it.

An investor which uses the brand new martingale strategy also needs to has a high-chance threshold and also manage the brand new mental stress you to definitely boasts large losings. The brand new Martingale method is a probability concept that has been delivered from the Paul Pierre Lévy, a French mathematician inside 1934. The idea wasn’t called until 1939 when Jean Ville created the definition of “Martingale”. The brand new Martingale approach within the a fan-cover is the belief that you can have one a bet or exchange to turn your fortunes as much as and steer clear of losses.

Just how do buyers create risk while using the Martingale means?

The fresh Martingale Method is a method investors attempt to profit because of the increasing its trade size on each loss, longing for an ultimate victory. As the approach is designed to recover losings with every winning exchange, it relies on the belief your investor have an endless source of investment and this the market industry will ultimately turn in its favor. Indeed, there’s no make sure a winning trade arise, and straight dropping investments can fatigue the brand new investor’s account balance.