The life span from a separate contractor can be one of independence and you may fulfillment. Youre responsible for that which you secure. You are in charges of the hours. You never report to some body. However, it can come with the display out of demands, including qualifying for a mortgage.

Don’t worry regardless if, You will find had the back. You are aware, the only youre learning at this time? I could take you step-by-step through just what it is wish qualify for home financing while a great 1099 employee otherwise separate specialist.

Let’s start by the fundamentals. Very first, might you qualify for that loan? Definitely! Or even, this would be an incredibly brief blog post and simply stop with no. Given that response is you to definitely 1099 employees and you will separate builders can also be qualify for home financing, there is certainly some more steps to track down here. That’s extremely just what I will focus on within this blogs post. The brand new how you can meet the requirements.

Action #1 is get data in order. Whenever you are these may are priced between bank so you’re able to lender, some tips about what you are going to give:

- Tax returns. The financial institution will be searching for your own 1099 income, and the taxation return can let you know so it

- Bank statements. This will be another way to show off your money, nonetheless it will even supply the bank some even more insight into your ability to settle the borrowed funds

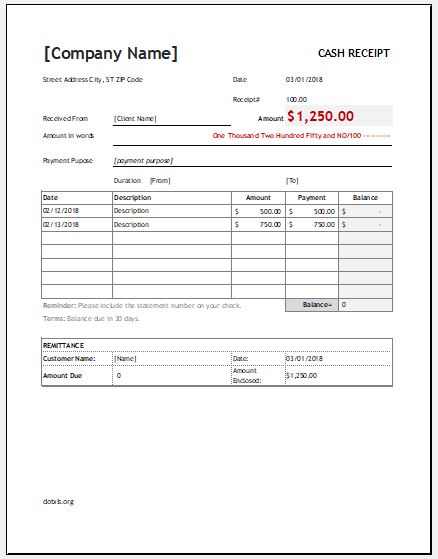

- Additional 1099 evidence of money. Or even earn adequate in the businesses you benefit to get a great 1099-MISC, you may want to display checks or any other types of payment together with financial comments

- Company financial comments. You will want a keen accountant to place such together if you lack them offered (Quickbooks otherwise accounting software may also be capable of so it for folks who keep the individual guides)

- Providers licenses. It style of relies on your community, but if you features a business licenses, it’s good to understand this readily available for the lending company

- Immigration papers. If you’re a foreign worker, you will have to demonstrate that you has actually a legitimate visa

- Credit card and you can loan statements. The lending company may want to visit your borrowing from the bank fitness (and examining your credit score)

- An effective W2 and you can paystubs. If you have an alternative jobs and you may discovered an effective W2 otherwise paystubs, the lender should document it money

Hey all, I’m Phil, and that i develop getting A horror toward Mortgage Road Blogs

It may seem wow Phil, which is loads of paperwork and you may you would be right. Obtaining a mortgage need numerous documents and you can files from the borrower. You should never worry even when, you’ve got that it. Whether or not it allows you to become any better, anyone must render a number of data files to apply for a mortgage – whether they is a beneficial 1099 staff member otherwise W2 personnel.

Another section of it formula is where do qualification work once you have provided these types of data files? Told you another way, what’s the bank looking for to choose when you are recognized otherwise denied? Lists will always an easy way to have a look at one thing, very I’ll lose this knowledge having fun with a different sort of list getting you.

- Credit rating. Having a solid credit score Nebraska personal loans is essential. Not sure exacltly what the credit history was? I would obviously recommend studying that it, right after which bringing methods to alter they if necessary. Paying down financial obligation and you may expenses expenses punctually will help

Because the paperwork, for each bank may differ, so this is only a kick off point you discover what’s up

Now could be a good time to inform you you to I might strongly recommend shopping around. Large financial institutions that offer old-fashioned money are not the only of these exactly who normally provide you money to own property. One starting place are Truss Monetary Group. The experts indeed there get a common sense way of financing, and you may help, just your money. If it sounds a beneficial, let them have a visit now.