Have you been a citizen with excess credit card debt? This informative article helps you determine whether you will want to get a beneficial cash-away mortgage to repay handmade cards. The bucks-out re-finance of established house lets residents to convert their a property security in order to bucks.

Cash-out of a beneficial re-finance can be used for nearly one purpose, including starting a corporate otherwise renovations. In such a case, to pay off highest-attention obligations for example playing cards or signature loans.

If you’ve got debt you aren’t by yourself. With regards to the New york Government Put aside, in the fourth one-fourth from 2022, personal credit card debt hit almost step 1 trillion dollars. That’s an excellent Trillion with good T. Which personal debt sells the typical rate of interest significantly more than 20%. There had been high alterations in both deals and you may credit card loans styles across the country.

I will be discussing when you should prefer a debt negotiation financing. We’ll and additionally break apart the effects it could have on your economic upcoming if one makes a belated fee. Eventually, we shall shelter the whole process of delivering a debt consolidation financial to pay playing cards.

How to determine if I ought to lay my personal credit debt towards my home loan?

If that hits household, or if you is actually maxed aside on the charge card stability, state over 50%, following continue reading. Maxed aside function their credit card balance reaches or close their borrowing limit.

Need a beneficial calculator, a home loan calculator, along with your bank card comments to do specific brief mathematics. Put the monthly installments against a recommended the fresh new mortgage payment. In the event the an alternative mortgage helps you save a ton of money circulate, then chances are you must look into merging your own credit card debt. Here are a few a deep plunge to the mathematics right here.

All your family members is like a business. As with any enterprises, it runs for the earnings. In the event the cash flow was strict, next restructuring obligations is a very common technique to increase cash flow and you may spend less.

Credit cards hold the best interest rates of any obligations. This makes reorganizing credit card debt with the a home loan attractive actually if financial cost are increased 29% on handmade cards vs. 7% toward mortgage loans. Personal credit card debt can be sent for decades through precisely the lowest payment.

Which have higher balance in your playing cards can damage the borrowing rating because of a boost in your own credit utilization rate. Credit application is the proportion of the utilized credit compared to their complete readily available borrowing limit, also it takes on a crucial role when you look at the determining credit scores. In case the balance are large, it will produce a diminished credit score, resulting in possible effects such as for instance higher rates of interest and you may restricted the means to access borrowing from the bank later.

For people who skip credit cards commission if you’re carrying maxed-out stability, the effect on your credit rating will be alot more significant than the destroyed a payment in the event your balance is actually down. This case can cause a risky course the place you constantly fight to catch up financially and find it difficult to help you be eligible for the brand new fund on account of less than perfect credit.

In case your opportunity can be acquired that you could spend your debts 29 days late, imagine taking cash-out so you’re able to combine your debt. When there is a belated percentage towards the all of your expenses, it does keeps a huge influence on your credit score. A belated percentage can impact their get https://cashadvancecompass.com/installment-loans-mn/ because of the as many as 180 circumstances and certainly will stay on the declaration for up to 7 decades.

Whenever you are cost can vary considering equity and you can FICO score, minimal FICO score required begins from the 620 and you may restrict equity that can be used for the money is 80%.

If you’ve usually got a premier credit rating, then you’ve probably enjoyed the main benefit of reasonable borrowing costs. not, the lowest credit rating could well keep you into the a detrimental economic years that’s difficult to split.

- You really have large payments to the expenses as you keeps a reduced credit history.

- You may have a decreased credit score as you provides highest repayments that get made late.

Which have handmade cards close to its limit have a terrible impact on your credit score. For many who and then make a belated fee, your score commonly get rid of a lot more.

The entire process of Bringing a home loan so you can Benefits Handmade cards.

If you’ve never ever acquired a mortgage so you can combine debt, then some tips about what the method turns out that have Homestead Financial.

If you decide to do a mortgage application which have Homestead Economic, most of these services was rendered free up front.

- initial Communication. It very first conversation could be by the phone call, text message, email, etc.

- Initial data. Immediately following discussing wants, a page out-of Recommended Accomplishments (LOPA) is sent to deal with the fresh borrower’s requirements. I including present this new court level of Web Tangible Benefit having the latest re-finance.

- Disclosures delivered and you may returned. Always delivered digitally, this will become the loan App (1003), Financing Guess (LE), and other disclosures.

- Processing. Shortly after a quality glance at to gain access to running, we will be buying:

- Appraisal

- Identity

- Follow through paperwork add so you can underwriting.

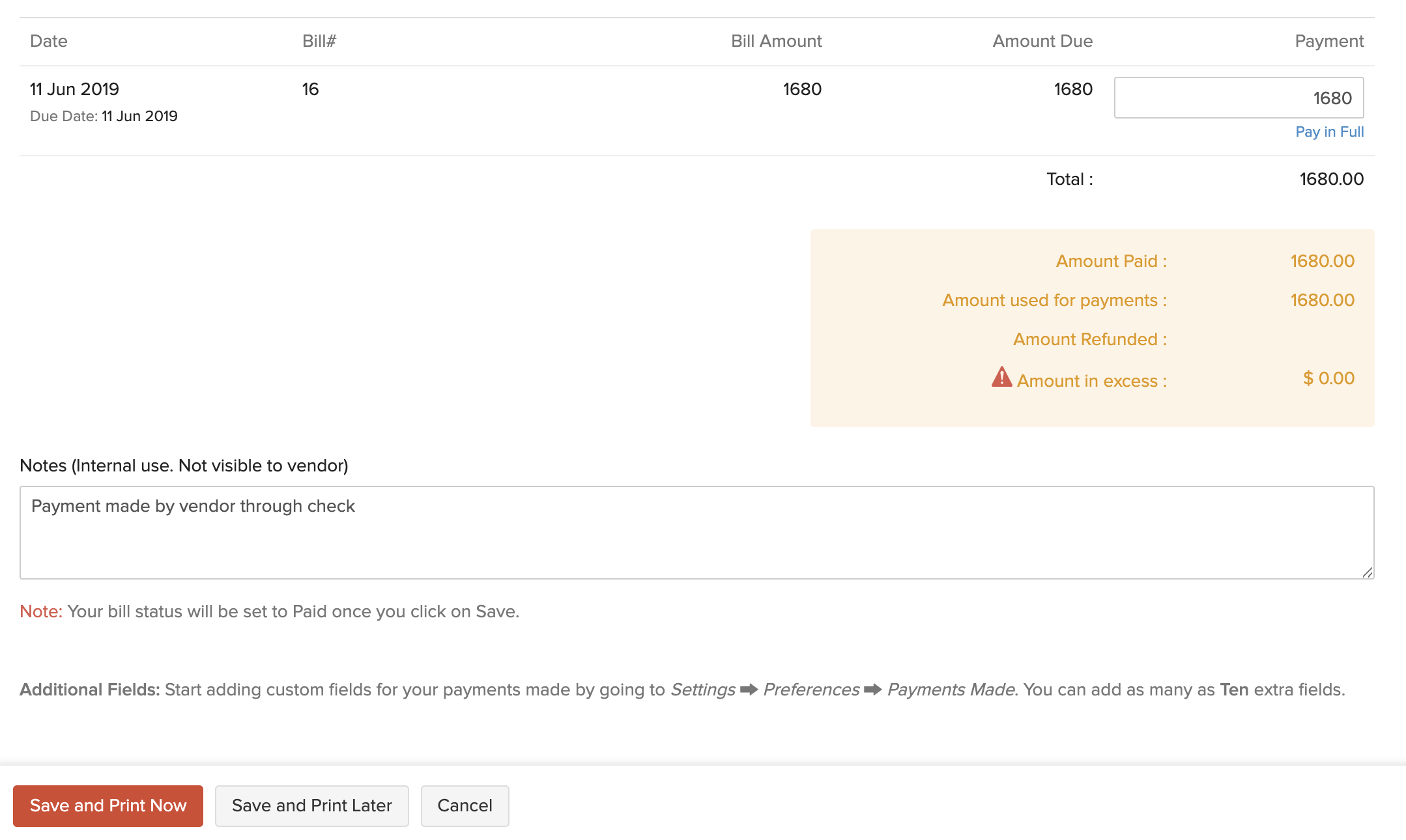

Certain checks perhaps be required to be distributed straight to their financial institutions. Some you are going to found produced payable to bucks. Make sure you put your mastercard comments towards the monitors sent in to avoid distress.

Everyone is currently carrying number quantities of personal credit card debt. Because of a bona-fide home directory scarcity, residential property can be worth more than ever, ultimately causing accurate documentation quantity of equity. So it domestic security merchandise a good opportunity to pay-off high-attract credit cards with a mortgage. A debt negotiation loan can help to save residents several thousand dollars in order to assist safer its monetary upcoming.