Conventional insights claims that you have to have lots of money so you’re able to buy property-20% of one’s price with the advance payment, getting particular. It is that really genuine? Not at all times.

As it happens you will find several channels so you’re able to home ownership you to definitely don’t need getting down 20 percent of the purchase price. This might be great news to possess people because the that kind of down fee can quickly add up to tens of thousands of bucks-or even more.

Wanting to know tips buy property versus a giant advance payment? Below are a few options to imagine, dependent on your eligibility.

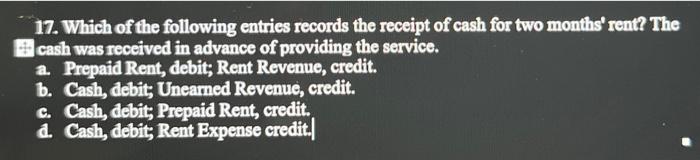

step one. Antique mortgages that have Individual Home loan Insurance coverage (PMI)

Of many lenders succeed homebuyers to obtain antique mortgage loans that have smaller than 20 percent down should they buy individual financial insurance policies-PMI having small. It is a variety of insurance policies one handles the lending company when the you miss mortgage costs. Specific lenders offer mortgage loans to very first-time buyers which have as low as a great step three percent advance payment, based on your credit history.

Even in the event PMI can also be set homeownership close at hand without having the money having a huge deposit, it comes down at a high price into the homebuyer. PMI money are often determined just like the a portion of your house loan, and that means you might possibly be expenses hundreds of dollars inside the PMI per month near the top of the home loan.

Some people dislike the thought of paying for insurance to safeguard the mortgage lender. But also for anybody else, PMI may be worth it to be in a position to purchase a house having less than 20 percent down.

Past PMI, your s that provide assist with consumers. Of several mortgage brokers, including Fulton Financial, render versatile methods to let buyers that have anything from settlement costs to securing inside aggressive rates of interest.

2. Va loans to have pros and you will effective services participants

Home loans throughout the U.S. Department off Pros Facts may help experts, productive solution users, and you will enduring spouses to shop for households with no currency down.

While qualified to receive a beneficial Va mortgage, you may also see competitive rates, that will help save very well the mortgage repayments.

Though Va funds bring many benefits to own consumers-in addition to no down payment necessary-definitely read the terms and conditions and make certain you are sure that the procedure for being qualified for a financial loan. Try to apply for a certification away from Eligibility to help you be sure towards bank that you are qualified to receive a great Virtual assistant financing. Whilst Virtual assistant doesn’t impose lowest credit criteria, your own lender may bring your credit history under consideration in advance of granting your loan.

step 3. USDA money for buyers for the outlying elements

Trying to find a home in the an outlying otherwise residential district community? That loan supported by the brand new You.S. Agency away from Farming you may enable you to definitely secure home financing which have zero advance payment anyway.

USDA funds arrive in the 0 % down. However, so you’re able to qualify for a great USDA mortgage, you will have to meet certain standards.

For example, you need to purchase a house for the an eligible outlying city. You can look getting a message toward USDA website to find out if your house is qualified to receive an excellent USDA loan.

In addition, you need to satisfy specific earnings conditions: Consumers loans in Emerald Mountain are unable to earn significantly more than simply 115 percent of the average income in the region in which these include to buy a house. Consumers as well as need to consume your house due to the fact a first house, so USDA finance commonly a choice for travel belongings or rental attributes.

cuatro. FHA financing to own flexible borrowing criteria

If you don’t have a strong adequate credit rating to meet the requirements to possess a traditional mortgage, you’re in a position to safe a federal Homes Administration (FHA) mortgage. These types of financing succeed consumers to get property with a down fee as little as 3.5 percent of the purchase price.

The same as Va loans and you can USDA finance, FHA funds is authorities-recognized money that provide significantly more versatile terminology than many old-fashioned mortgage loans.

Whether or not FHA funds can be tempting along with their low down repayments and versatile credit requirements, they also have a few drawbacks, and additionally constraints for the financing numbers and additional documents to possess people.

The fresh new FHA will not give fund individually; people have to run qualified individual lenders so you’re able to safe that loan. To look to your FHA loan solutions in your area, seek out regional loan providers to the U.S. Institution regarding Housing and you may Urban Invention web site.

Whether you are trying to a normal mortgage or interested in learning your own qualifications getting government-recognized finance, a dependable financial advisor can help you get the best alternative for you. Because of the wanting that loan having versatile downpayment requirements, the right path to help you homeownership can be a little much easier.