Domestic Guarantee Personal line of credit: Financing getting a borrower with the ability to borrow cash at the time plus the total amount brand new debtor decides, around an optimum credit limit by which a debtor have accredited. Fees try protected by the equity regarding borrower’s domestic. Effortless desire (interest-only) costs on the balance) is often income tax-deductible. Usually used for renovations, significant orders or expenditures, and you will debt consolidating.

Home Guarantee Loan: A fixed otherwise changeable speed mortgage received for various aim, shielded because of the security of your property. Attract paid off might be taxation-allowable. Often utilized for home improvement and/or releasing regarding collateral getting resource various other real estate or other investment. Required by many to replace otherwise solution to consumer money whose interest isnt income tax-allowable loans Millbrook, particularly vehicles otherwise vessel loans, credit card debt, scientific loans, and you may academic money.

HUD: The fresh new Department from Construction and you can Metropolitan Creativity is dependent of the Congress in the 1965 that is accountable for the latest implementation and you can management out-of regulators housing and you may urban creativity apps. This type of applications become society think and development, construction production and home loan insurance (FHA), additional financial market issues (GNMA) and you will equivalent options into the homes.

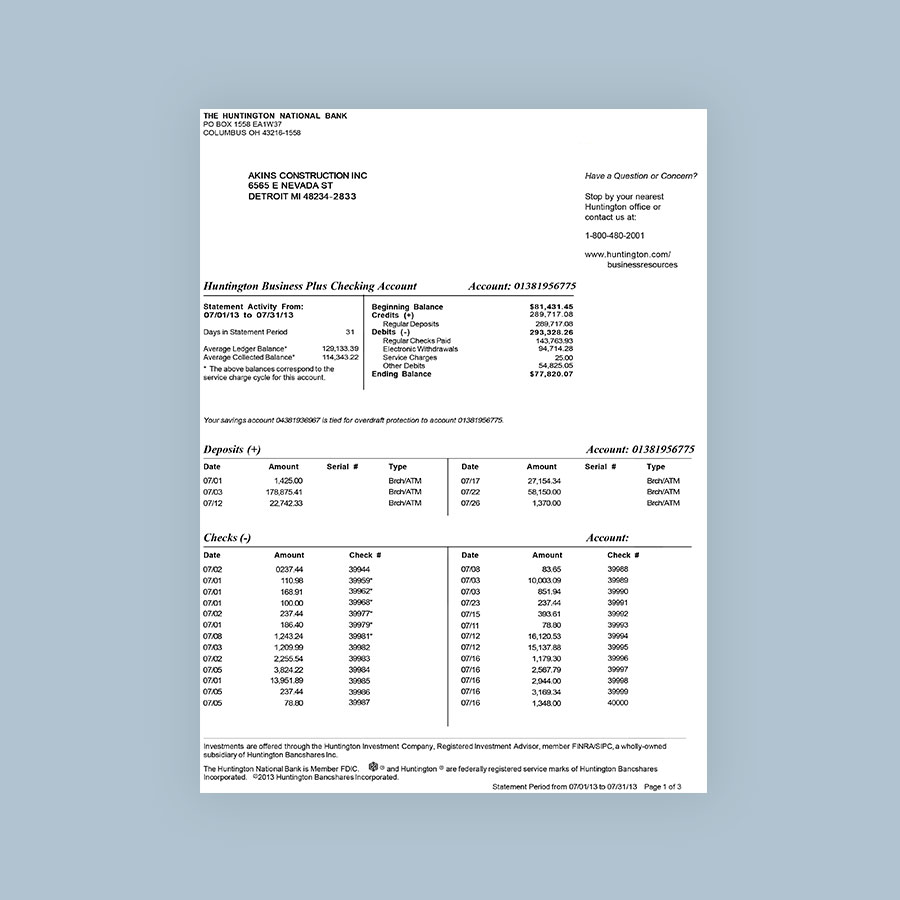

Inside will be the payment charge towards the debtor, the degree of the loan become paid down, the fresh terrible count owed throughout the borrower, the principal level of the fresh new mortgage, and any other places otherwise fees

HUD-1 Settlement Declaration: So it document is generated within close from escrow and you may details all of the will cost you and you can costs that were acquired otherwise paid off when you look at the loan. Continue reading