Find out if zero House Guarantee Mortgage on home is filed getting a loan with bad credit Vineland over the past 12 months, regardless of whether it has been released.

If a home Equity Financial try registered in the last season, pick Paragraphs step 3 and 4 above towards Connection and do not Close to the yet another Family Equity Loan until 12 months features introduced given that tape from past Domestic Security Home loan

Verify that the new insured Household Security Financial (1) discloses one “The brand new Expansion Of Credit Is the Particular Credit Laid out From the Point 50(a)(6), Article XVI, Texas Structure” otherwise comparable words [saying its good “Home Collateral Home loan” isnt adequate], and you will (2) your revelation is actually Conspicuous [ a good revelation try obvious in case it is into the large print, is actually bold (and you will rest of text is not), and/or is underlined (and rest of text isnt).] The brand new Federal national mortgage association/Freddie Mac “Tx House Collateral Cover Appliance (Cash out – Basic Lien)” consists of an obvious revelation. “A printed going in the event that capitals. is actually obvious. Vocabulary in the body out of a questionnaire is “conspicuous” in case it is during the large or other researching kind of or color.” Section step 1.201 Business and you can Business Code. “The reality that the production heading keeps a much bigger font size compared to launch language does not by yourself make discharge obvious.” Littlefield v. Schafer, 955 S.W.2d 272. Look for Point 1.02, Company Company Operate.

Fannie mae means the fresh new Recommendations prohibit closing until the lender’s said go out

[You can utilize new T-42 which have preprinted Part dos(f) for people who are that it paragraph.] Check if the fresh new Mention and you can the newest insured Household Collateral Home loan is executed at your term company place of work. Call us in the event the Home Security Mortgage is executed in the another term team. When your Notice and Home loan are carried out within lender’s work environment or elsewhere, point brand new T-42 hence does not include part dos(f) (otherwise line as a consequence of and 1st Section dos(f)). Federal national mortgage association means every paragraphs as well as 2(f) be included in coverage.

When the closure directions demand, therefore concur, bring independent duplicates of the many files signed of the citizens/individuals at the office to each and every partner (along with HUD-step 1 as well as your Family Equity Affidavit, hence acknowledges bill.) Federal national mortgage association suggests that Recommendations need duplicates be provided with toward consumers. Continue a copy of all files closed because of the borrowers.

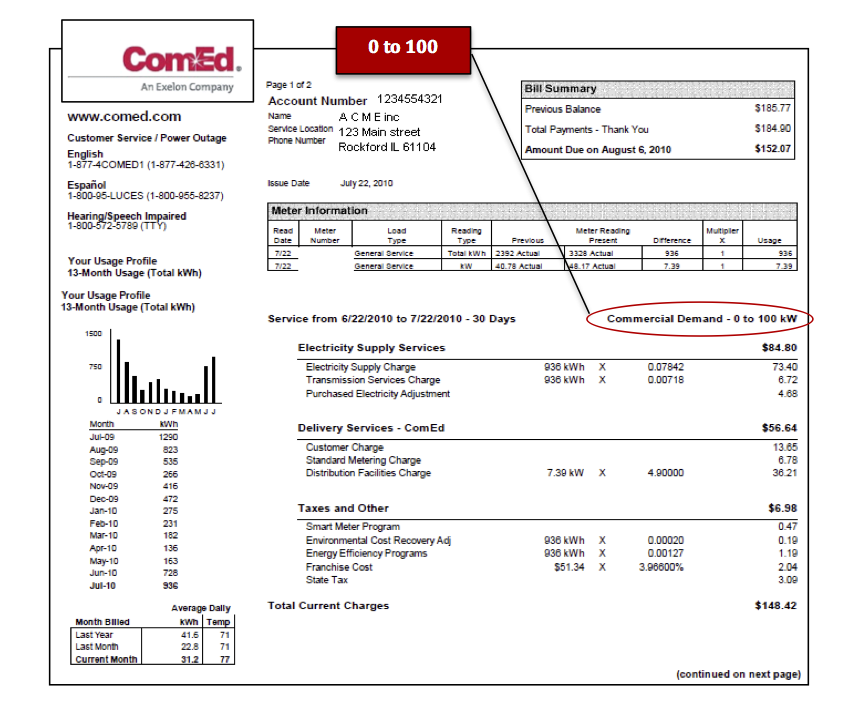

If closing guidelines request, send a copy of Closure Disclosure or separate piece demonstrating every fees that show up on the last Closing Disclosure or you will collect, disburse or spend. Choose if or not you’ll accept closing rules (1) that require you to dictate your costs do not meet or exceed 2% of one’s new house Equity Financing, or (2) that want you to definitely complete a calculation piece. Federal national mortgage association shows that Information that the financial agree the settlement report indicating most of the fees getting implemented or accumulated of the term organization.

When the closure rules consult, decide if or not you will comment the fresh new data signed on the work environment to ensure there aren’t any blanks when the borrowers indication (except bill otherwise jurat). Certain will demand one to make sure just you to definitely files you get ready have no blanks. Look for closing advice which need you to definitely make sure no blanks in other data or even be sure fundamentally “conformity having [every guidelines, Subsection (a)(6), etc.].” Federal national mortgage association indicates the brand new Instructions believe that zero records provides blanks when the owner signs.

When the closing instructions request, dont close or help borrowers sign data just before a stated time. A reported day is actually a specific date stated in the brand new closure information or the time of one’s tools drawn up because of the bank. Decide if or not might undertake closing directions that need you to definitely determine the fresh new go out to close off otherwise that require one assess the brand new time to close.