- Addition

- Variety of pond financing

Associate hyperlinks towards issues in this post are from people one to compensate all of us (come across our very own advertiser revelation with our selection of partners for much more details). However, our very own viewpoints try our very own. Find out how i rates signature loans to enter objective studies.

- Adding a swimming pool to your home is usually this new most expensive projects your deal with.

- Resource choice is pool financing, domestic equity, otherwise funds from the contractor or company.

- A special pool will likely incorporate anywhere from 5% to eight% towards the residence’s overall value.

As to why invest in a pool?

A patio pool can augment the fun you earn of your residence and boost its well worth meanwhile. But not, adding a share is one of the higher priced household-improve projects you might accept.

Household equity finance and you may HELOCs

Property equity mortgage is actually an option for capital your pond. This can be best for anyone who has high guarantee created up within homes. With a home equity mortgage, your use a lump sum according to research by the property value the domestic, without having the balance toward financial. Your residence functions as guarantee on mortgage. This new installment terms towards the property equity loan can range away from four to help you three decades, and also the rate of interest may be fixed.

But not, it is important to remember that defaulting into a house security mortgage you could end up foreclosure, so it carries considerable risk.

Such property security loan, a house equity credit line (HELOC) leverages the new equity built up on your property. Making use of your own home’s guarantee with an effective HELOC is much like playing with a charge card, in the event a HELOC just talks about a predetermined time period, known as the draw several months. HELOCs usually have adjustable rates as well as the fees terms is also getting longer than that of house collateral fund.

Note that this new mark period can get last for much longer compared to the pool construction, and you could face more charge to have closure new collection of borrowing from the bank early. You will want to remember that interest rates for the an excellent HELOC, and thus monthly installments, can be change over time.

Unsecured personal loans

A swimming pool financing try a well-known choice for resource a pool. Its a consumer loan one to a lender places especially because the an approach to buy the purchase and you can installing an excellent pool.

As they are signature loans, you might get a share loan off a bank, borrowing from the bank commitment or on the web financial. Any lender you select, you will discovered a lump sum payment to set towards the pool and you will pay in the repaired monthly payments, with focus, more than a designated title.

“Pool loans normally have a term of 5 in order to fifteen years, on interest rate essentially contingent to your borrower’s credit history,” claims David Krebs, a large financial company inside the Florida. “A get of 650 or maybe more might be desired for most readily useful rates.”

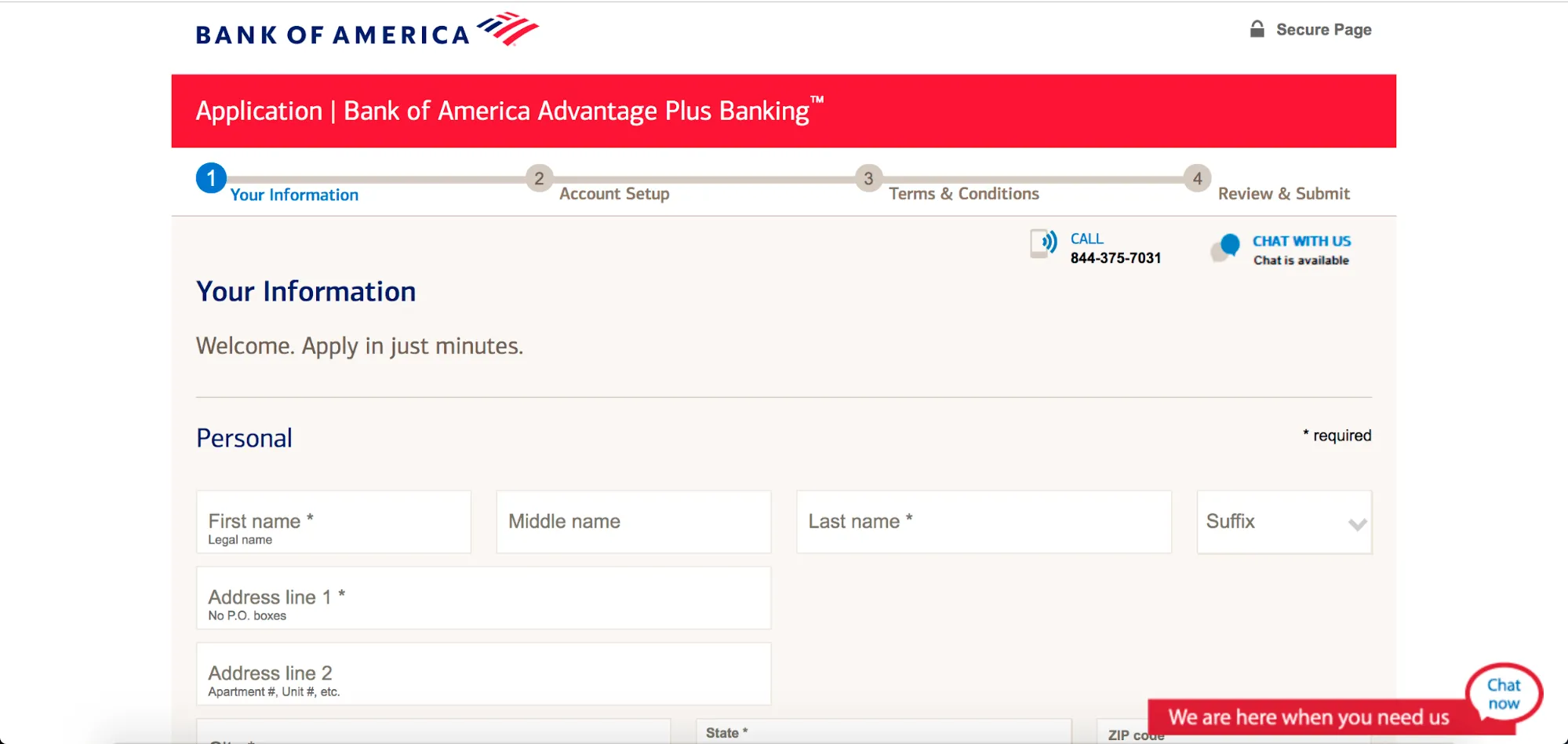

You get a pool loan the same way you have made a consumer loan for other goal. Of many loan providers will allow you to prequalify for a financial loan having no influence on your credit score, enabling you to understand the prices and you will conditions he’s probably to give before you can submit out a full software.

Pond money using pool enterprises

Certain pool suppliers otherwise people promote financing to users. They might possess partnerships which have financing organizations otherwise provide inside the-family financing choice. The same as specialist resource, a loan put up via a plant or specialist can provide an excellent streamlined processes because the investment was provided on the pond buy.

But not, an equivalent caveats apply. You should carefully review this new terms, rates of interest, and you can charge for the investment offerparing offers from additional manufacturers or buyers and you may investigating almost every other capital choices makes it possible to select an educated bargain.

Contractor financial support for your pond

Of many pond contractors provide her money choices to help people buy the pool construction. Such applications are generally arranged due to partnerships having lending organizations. Company financial support will be a handy option since builder takes care of the applying processes as well as the loan terms and conditions, however, home owners are going to be mindful because there is the possibility issues of interest.

Evaluating options

So you’re able to qualify for a share mortgage your usually you want a card get away from 650-680. For those who have a high rating you can have a tendency to get more favorable terms and conditions check this link right here now, such as all the way down interest levels. It is crucial to very carefully comment the newest fine print, together with rates of interest and you will costs, to ensure that you are becoming a favorable bargain.

Resource options are significantly more restricted that have less than perfect credit, but some lenders provide unsecured unsecured loans that have highest rates of interest for these style of people. While doing so, pond enterprises might have investment plans you to definitely fit a broad diversity of borrowing from the bank users.

Household equity funds typically give all the way down rates since they’re shielded up against your residence. Unsecured unsecured loans, in addition don’t require guarantee, and may function as the better alternatives.

Resource terminology differ from the financial, but domestic security funds and you will HELOCs may have terms and conditions as much as 20 years. Unsecured unsecured loans often have less words, between dos so you can 7 many years.

Certain authorities pool funds was unusual, nevertheless will dsicover choices for opportunity-efficient or “green” swimming pools you to qualify for unique financial support. You could also see rebates lower than local government times-saving programs.

Just before financial support a swimming pool, take into account the total price and additionally maintenance and you will insurance, the way the pond usually apply to property value, and you can whether thrills and use of one’s pond justify the money.