Score a loan pre-acceptance regarding a lender knowing your limitation loan amount and tell you sellers you are a life threatening buyer. Within the pre-approval process, a lender assesses your financial situation and creditworthiness to determine your maximum amount borrowed and gives a conditional connection to have capital.

3: Ready your loan data files

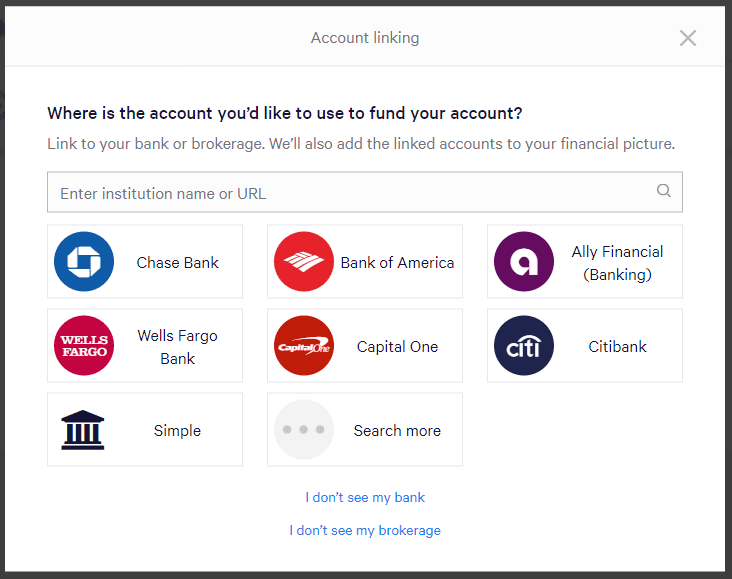

Collect necessary data, particularly proof of money, savings account, bank statements, character, taxation statements, and borrowing reputation on your own country out-of supply, to help with your loan application.

Choose compatible funding services within your budget and work out an give for the one that most closely fits their criteria. You states of many international investors believe become Arizona, Texas, Florida, Illinois, and you will Vermont.

Step 5: Mode good All of us organization particularly an enthusiastic LLC

Expose a great Us-situated entity, such a finite accountability company (LLC), to hold the new investment property and gives accountability cover. To create a keen LLC, one must file Articles out-of Organization with the suitable county institution and you may afford the expected filing costs.

Step six: Finalize the loan software

Submit their finished loan application and you will help data files on bank having opinion, making certain the requisite info is precise or more-to-day to help you assists a flaccid and you will efficient mortgage approval techniques.

Action eight: Lock the pace

Securing the speed function securing a certain rate of interest into a loan getting a-flat period, normally 30 so you’re able to 60 days. This handles the latest debtor out of potential motion from inside the market costs while in the the mortgage acceptance techniques, making certain it have the arranged-on speed in the closure, no matter field criteria.

Action 8: Loan control and you may underwriting

The lending company will guarantee all the criteria try came across and you can ensure your economic information. Underwriting advice are predicated on four fundamental facts: Worth of, debt-service-publicity ratio (DSCR), borrower’s exchangeability, and you can credit profile at home nation.

Step 9: Conduct a property examination and assessment

A professional inspector explores the latest property’s condition throughout a property inspection, determining potential situations or requisite fixes. Into the an assessment, an authorized appraiser evaluates the house to add an impartial guess of the market value, helping the lender confirm that the borrowed funds number is acceptable for the latest property’s worth.

Action 10: Prepare for closing or take palms

Accentuate loans Lordship towards the bank, identity team, and you will seller to make certain most of the required records have been in purchase and fund are offered for transfer. Opinion and sign every finally documents within closing fulfilling, afford the required closing costs, and you may get the secrets to your brand new money spent, marking the completion of your own mortgage process additionally the start of disregard the journey.

Why Smart People Use Capital for rental Assets

Smart people tend to trust money purchasing local rental characteristics as an alternative regarding expending dollars for the whole purchase price. You can find reason why investment was an appealing option for investors, and it often contributes to increased return on investment (ROI):

- Money accommodations property could offer dealers a taxation-successful strategy for improving their funds disperse. Of the subtracting loan attention payments using their pre-tax earnings, people is also drop off the tax responsibility, that can provide money that can be reinvested within property or used for most other opportunities. So it improved earnings can help people diversify their collection, boost their leasing property, or buy most rental characteristics to create a higher return for the money.

- Having fun with funding might help decrease chance. By using a mortgage system to borrow money in the place of spending cash, people decrease the chance coverage by continuing to keep extra money to your hand in matter-of issues.

- Going for a smart mortgage selection for money will help people magnify returns. Leveraging other’s money as opposed to just relying on their particular financing can allow traders to get alot more characteristics and you will possibly feel greater like and cash disperse output. This leads to more important enough time-term money manufacturing and you can a very diversified collection.