Express

If you have ever applied for that loan, you have likely read the word underwriting just before. If you have ever wondered exactly what underwriting is and just why it is done, we have been right here to make it more straightforward to discover – particularly in regards to home loan lending.

Basically, underwriting try a means of securing both bank as well as the borrower in the a financing situation. In advance of a lender can also be agree your to have a home loan, the bank will need to be certain that it will be easy to invest the bucks straight back which have monthly premiums. The procedure by which a lender analyzes your ability to invest your debt duty out of a home loan is known as underwriting.

A financial, borrowing from the bank commitment, or mortgage lender – any bank you choose to work on on your home loan – have a tendency to assign a home loan underwriter towards the mortgage. One to underwriter have a tendency to comment all records, check your credit rating, review your current costs and you will financial obligations, seem sensible their assets, and you may assess their possible exposure because the a borrower.

Just after they’ve finished which remark, an advice is generated towards the even though you need to be offered the mortgage. This action protects the bank, but inaddition it handles you against foreclosure, bankruptcy, otherwise both.

What takes place from inside the underwriting?

In case the loan application motions to the underwriting phase, debt pointers would be carefully analyzed. That it pledges your bank was granting loans in order to creditworthy somebody who aren’t prone to standard.

The essential and that is requested from you, the newest debtor, in this stage should be to have even more documentation or perhaps to describe or describe any results inside overview of debt records.

What exactly is a keen underwriter looking?

- Credit rating. Are you willing to meet up with the minimum credit history standards for the financing kind of you happen to be asking for?

- Credit history. This declaration includes details of one’s percentage background. The underwriting cluster will want to notice that you historically left with your loan costs. With this review, they plus comment people range facts and decisions, and one earlier in the day bankruptcies.

- Money. Your loan processor usually alone ensure the fresh new getting information you provided while in the running. As they comment your own documents, might assess the money you can use to be considered based on a minimum of 2 years of earnings records.

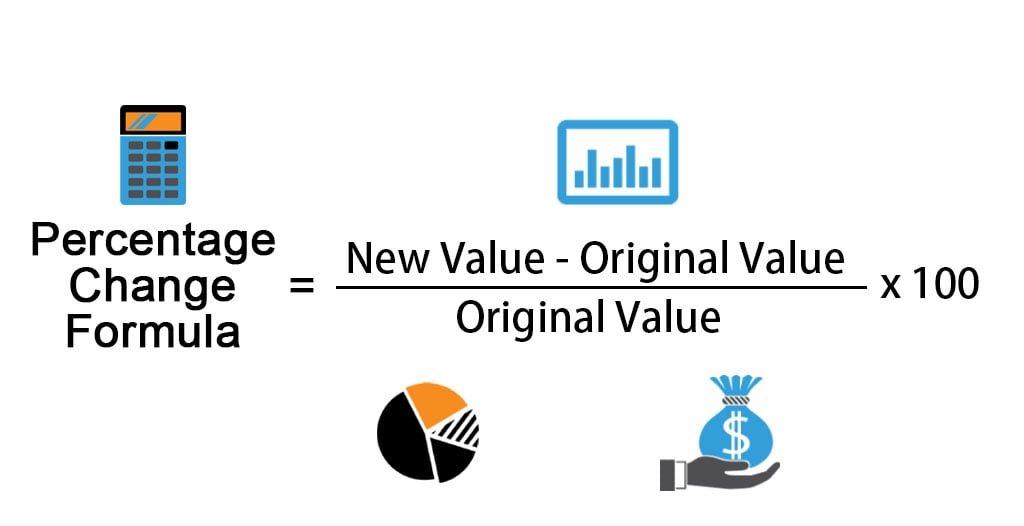

- Financial obligation ratio. Underwriters have fun with a personal debt-to-money ratio to evaluate your financial liberty. They are going to evaluate the funds you draw in monthly to your recurring payment loans to choose whether or not you have got adequate income to cover any present financial obligation therefore the price of a special financial set in your monthly payments.

- Coupons. The newest underwriting team will at the savings account to be sure there is the currency and then make their down-payment and you will coverage the closing costs – including in which you acquired those funds. If your deals was current, you are inquired about the information of recent deposits. In the event the deposit is offered because of the payday loan San Acacio a present, otherwise from the offering most other assets including a different house, they will certainly comment papers to know exactly how much of these money is present to have closure.

- Label functions. The name business you selected during the application processes offers the financial institution with an ensured protection interest in your residence. During the closure, the lending company places an excellent lien on your property, which suppress you against offering it until the financing was reduced entirely or will get an element of the closure off a sale. (It lien is also exactly what supplies the bank the right to foreclose to the a house if the a borrower doesn’t pay since the assented.) The fresh new underwriter have a tendency to comment the requirements invest brand new term union to be sure a profitable closure.

- Insurance. Underwriters have to make sure you reside totally covered and you will will remark one insurance coverage you have as part of so it procedure.

The fresh brief respond to: This will depend. Some affairs is located at gamble throughout the underwriting process. The amount of time it will take to examine their financial completely have a tendency to are different according to the complexity of your income and property, debt obligations, and so many more points. It can take as low as a short time for this opinion, otherwise doing a few weeks. Relax knowing their group at UBT work due to the fact effectively that you can to really get your mortgage closed in the latest shortest matter of time.

To speed up the method out of a borrower standpoint, making sure every expected paperwork is actually filed promptly is very important. Giving an answer to any questions or desires regularly is as well as ideal for a more quickly closure.

Behavior away from underwriting

The very last step up the fresh new underwriting processes ‘s the lender’s decision. The option is usually four choices for the lending company:

- Recognized. Hooray! Financials have order, the brand new residence’s well worth is within line together with your render, plus the identity lookup did not know one factors. Your own financial tend to agree your loan and issue a good obvious to close off dedication on your financing.

- Declined. The financial institution has actually figured both the home cannot see its conditions to help you qualify for buy, or the financials was in fact too high-risk into the loan. Cannot depression; this does not mean you won’t ever be considered, and your mortgage manager will allow you to understand this brand new denial occurred. Might together with direct you about what strategies when deciding to take which means you can be meet the requirements later on. The way to avoid a shock denial into the underwriting was becoming completely transparent regarding your financial situation when controling your own UBT financing manager.

2nd procedures

Once you’ve already been acknowledged and you can cleaned for closing, you can place a closing big date together with your financing administrator and you will term company. Great job – develop you are doing something you should commemorate which milestone!